Business Insurance in and around Nesconset

Searching for insurance for your business? Look no further than State Farm agent Dennis Scannell!

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

Operating your small business takes creativity, time, and quality insurance. That's why State Farm offers coverage options like business continuity plans, errors and omissions liability, a surety or fidelity bond, and more!

Searching for insurance for your business? Look no further than State Farm agent Dennis Scannell!

Almost 100 years of helping small businesses

Cover Your Business Assets

At State Farm, apply for the excellent coverage you may need for your business, whether it's a barber shop, a farm supply store or a book store. Agent Dennis Scannell is also a business owner and understands what you need. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

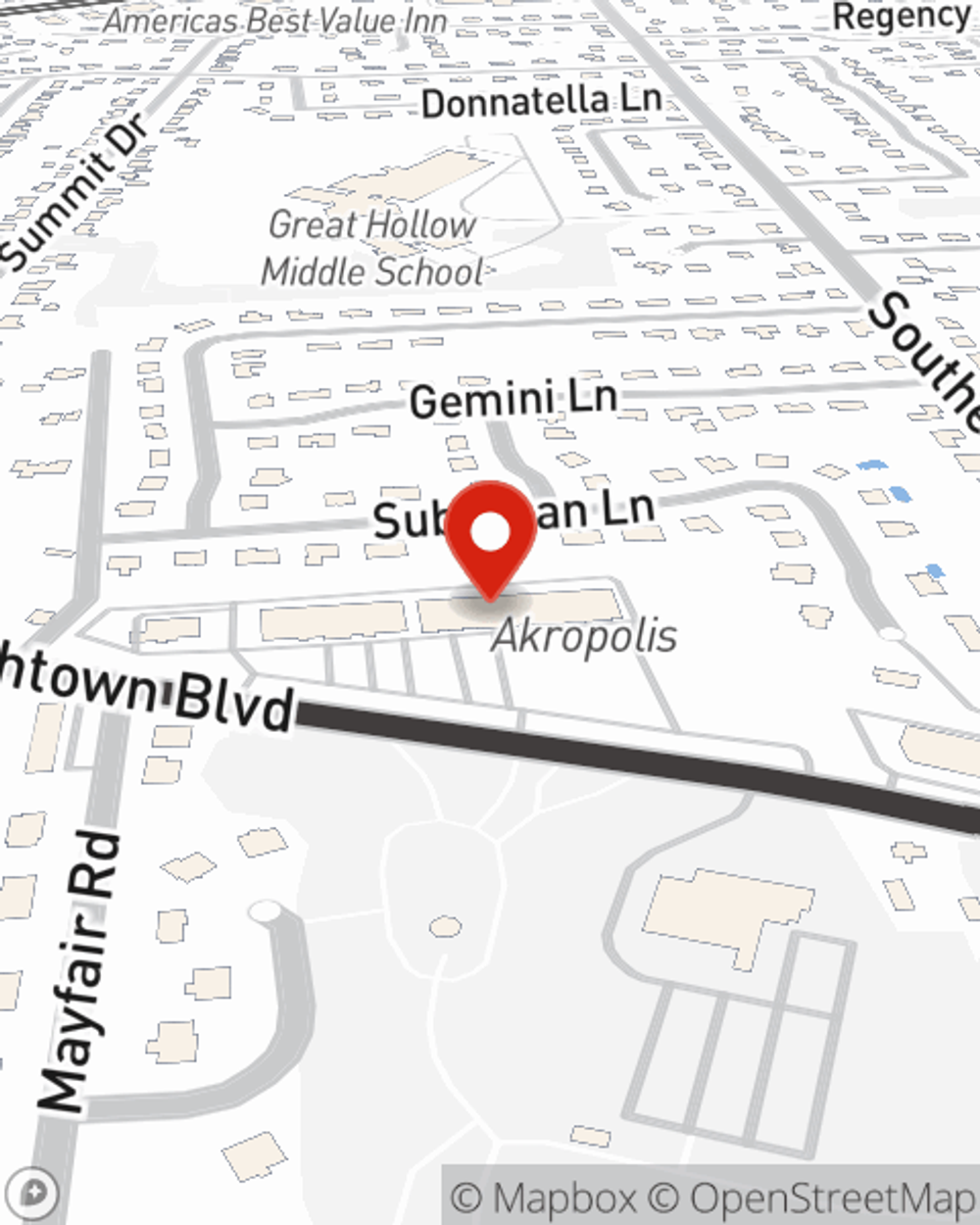

Get right down to business by visiting agent Dennis Scannell's team to explore your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Dennis Scannell

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?